Filing taxes can feel like navigating a maze of numbers, rules, and looming deadlines. Over the past decade, do-it-yourself (DIY) tax software has exploded in popularity, promising users a quick, low-cost way to stay compliant from the comfort of their couch.

At the same time, accountants remain the traditional go-to for anyone who wants expert guidance and reassurance. Understanding how the two options stack up on convenience, cost, accuracy, and long-term value can help you decide which route best serves your financial goals.

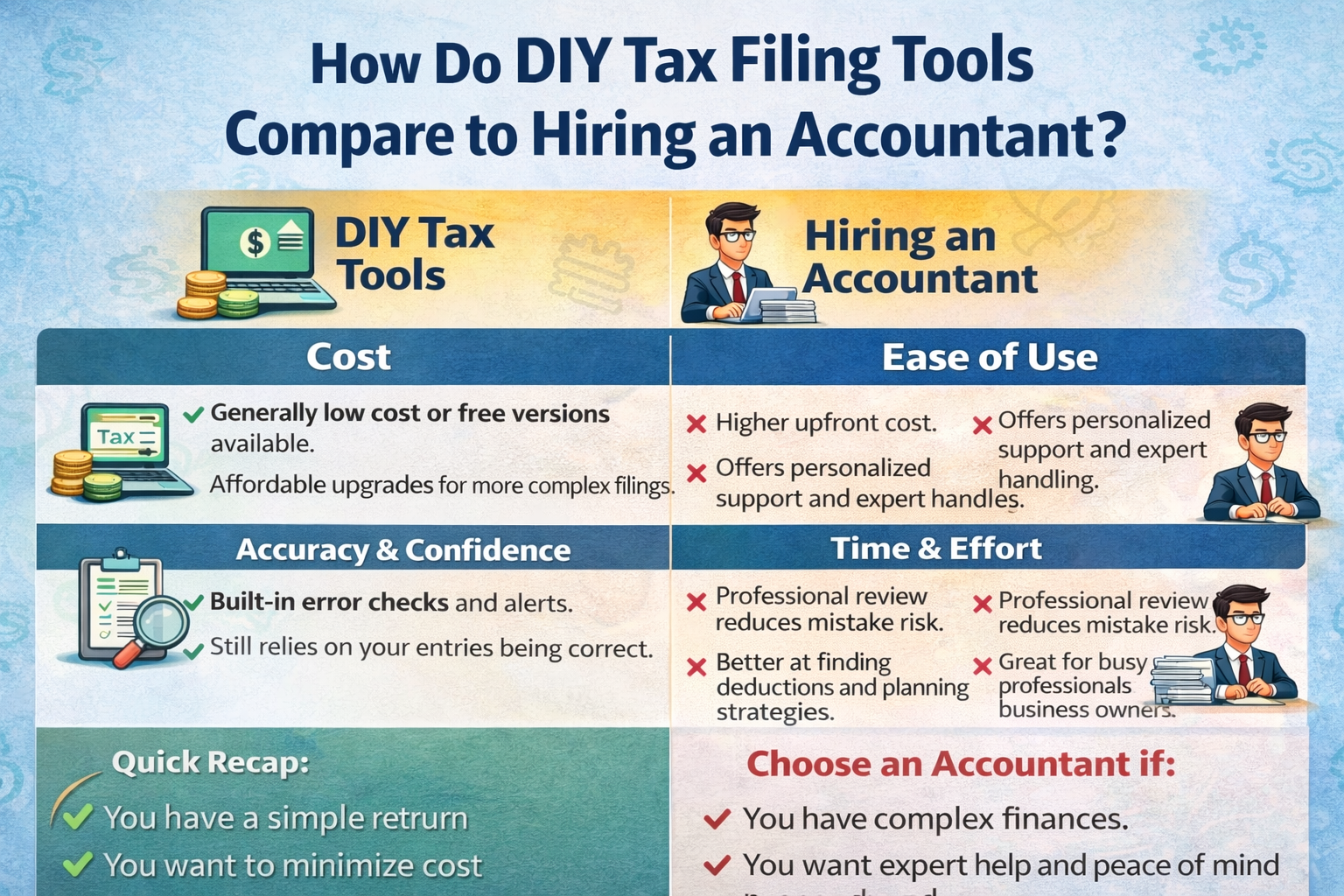

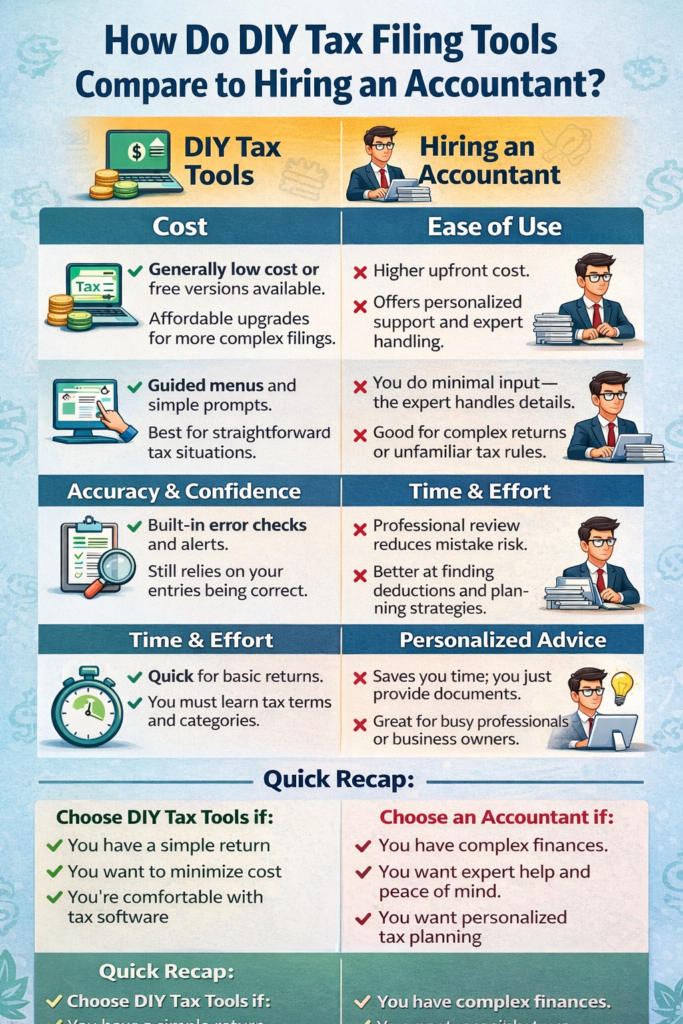

Convenience and Speed of DIY Platforms:

DIY tax tools are designed for efficiency. Guided questions, automated calculations, and real-time error checks streamline the filing process, often allowing a straightforward return to be completed in under an hour. Because these platforms are available 24/7, night owls and weekend warriors alike can file whenever inspiration—or a rapidly approaching deadline—strikes.

Mobile apps further boost flexibility, letting you snap photos of W-2s, upload receipts, and finish your return during a lunch break. For tech-savvy taxpayers with uncomplicated finances, the immediacy of DIY software is hard to beat.

Cost Considerations:

Price is where DIY systems typically shine. Many providers advertise a free tier for basic federal returns and charge modest fees—usually under $100—for state filings or intermediate features such as itemized deductions. By comparison, hiring an accountant often ranges from a few hundred dollars for a simple return to well over a thousand for complex portfolios involving rentals, multiple states, or self-employment income.

Yet cost alone doesn’t tell the whole story: a seasoned professional may spot deductions or credits you’d otherwise miss, potentially offsetting their fee through a larger refund or smaller tax bill.

Also Check : making your construction company greener

Accuracy and Peace of Mind:

Even with smart algorithms and built-in prompts, DIY software relies on user input. A mistyped Social Security number or overlooked 1099 can trigger delays or penalties down the road. Accountants offer a human safety net; they ask follow-up questions, examine supporting documents, and interpret gray areas in tax law that software might oversimplify.

In the event of an audit, most DIY platforms provide limited support, often only pointing you to an FAQ section. A certified public accountant, on the other hand, can represent you before the IRS and defend the reasoning behind every entry on your return, giving many filers invaluable peace of mind.

When Professional Insight Makes the Difference:

Life events—starting a business, exercising stock options, inheriting property, or planning for retirement—introduce complexities that generic software scripts may not fully address. In such cases, partnering with a full-service accounting firm can yield tailored strategies that go beyond annual compliance, such as quarterly estimated-tax planning, entity structuring, and cash-flow forecasting.

These services turn tax preparation from a once-a-year chore into an ongoing, proactive relationship that supports broader financial goals and minimizes surprises.

Conclusion:

DIY tax tools and professional accountants both have their place. If your return is straightforward and your primary concern is quick, low-cost filing, modern software will likely meet your needs.

However, if your financial picture includes multiple income streams, major life changes, or a desire for strategic guidance, the seasoned eye of an accountant may prove far more valuable than the difference in fees. Ultimately, choosing between the two boils down to balancing convenience, cost, accuracy, and the depth of advice you want by your side come tax season.

FAQs: DIY Tax Filing Tools vs. Hiring an Accountant:

1. Are DIY tax filing tools cheaper than an accountant?

- Yes. DIY tools usually cost less, especially for simple tax returns.

2. Are DIY tax tools accurate?

- They’re accurate if you enter correct information, but they lack expert review.

3. When should I hire an accountant?

- If you have complex finances, multiple income sources, or run a business.

4. Do accountants help you save more on taxes?

- Often yes—they can find deductions and plan strategies DIY tools may miss.

5. Which option saves more time?

- DIY tools are quick for simple returns; accountants save time for complex ones.